Income tax how to calculate bonus and free malaysia today malaysia personal income tax guide 2019 ya 2018 money malay mail malaysia personal income tax rates table 2017 updates 85 info tax exemptions malaysia 2019. Assessment Year 2018-2019 Chargeable Income.

Tax Information What Are Taxes How Are They Used

Income attributable to a Labuan business.

. 13 rows Personal income tax rates. Income Tax Rate Table 2018 Malaysia. 20182019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope.

On the First 5000. Income tax rates 2022 Malaysia. From the period of 112014 until 31122018 disposal in the sixth year after the date of acquisition of the chargeable asset is nil.

Unlike the income tax rates for 2018 and 2017 there is virtually no change in income tax reliefs for the two assessment years. Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region. Income Tax Rates and Thresholds Annual Tax Rate.

Malaysia Personal Income Tax Rate. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with. Personal income tax in Malaysia is charged at a progressive rate between 0 28.

Tax relief refers to a reduction in the amount of tax an. Introduced PCB Schedule Mode where PCB amount will match LHDN PCB Schedule. The latest Personal Tax Rate for the resident is as follows.

The Personal Income Tax Rate in Malaysia stands at 30 percent. Resident Individual Tax Rates for Assessment Year 2018-2019. Corporate Income Tax.

Malaysian Income Tax Rate 2018. On the First 5000 Next 15000. Disposer who is not citizen and not permanent resident or an executor of the estate of a deceased person who is not a citizen and not a permanent resident or a company not incorporated in Malaysia.

The deadline for filing income tax in Malaysia is April 30 2019 for manual. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020. Chargeable Income Calculations RM Rate TaxRM 0 - 5000.

Malaysia Personal Income Tax Guide 2018 YA 2017 Calculating personal income tax in Malaysia does not need to be a hassle especially if its done right. In 2018 some individual tax rates have been slashed 2 for three slabs Chargeable Income Bands 20001-35000 35001 50000 50001 -70000 will now be taxed 3 8 14 respectively. Read on to learn about your income tax rate and filing your 2018 personal income tax with LHDN.

EIS is not included in tax relief. The tax rebates below are applicable to expatriates who is a resident status and have stayed more than 182 days in Malaysia in a calendar year. Now that youre up to speed on whether youre eligible for taxes and how the tax rates work lets get down to the business of actually filing your taxes.

There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so. Calculations RM Rate TaxRM 0 - 5000. Malaysia personal income tax guide 2019 ya 2018 money malay mail the gobear complete guide to lhdn income tax reliefs malaysia malaysia personal income tax rates table 2017 updates taxplanning budget 2018 wish list the edge markets.

Malaysian Income Tax Rate 2018 Table. Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system.

Removed YA2017 tax comparison. 20182019 Malaysian Tax Booklet. The system is thus based on the taxpayers ability to pay.

Official Jadual PCB 2018 link updated. Below are the Individual Personal income tax rates for the Year of Assessment 2021 provided by the The Inland Revenue Board IRB Lembaga Hasil Dalam Negeri LHDN Malaysia. This means that low-income earners are imposed with a lower tax rate compared to those with a higher income.

Whats people lookup in this blog. Things That Might Seem Tax Deductible but Actually Are Not. The following rates are applicable to resident individual taxpayers for YA 2021 and 2022.

This page provides - Malaysia Personal Income Tax Rate - actual values historical data forecast chart statistics economic calendar and news. Personal Income Tax Rate in Malaysia averaged 2729 percent from 2004 until 2020 reaching an all time high of 30 percent in 2020 and a record low of 25 percent in 2015. A non-resident individual is taxed at a flat rate of 30 on total taxable income.

20182019 Malaysian Tax Booklet Personal Income Tax. Personal Income Tax Rate in Malaysia remained unchanged at 30 in 2021. 8 EPF contribution removed.

Data published Yearly by Inland Revenue Board. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any. Income tax relief Malaysia 2018 vs 2017.

These will be relevant for filing Personal income tax 2018 in Malaysia. Income Tax Rate Table 2018 Malaysia. The income tax filing process in Malaysia.

Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share capital of MYR 25 million and below at the beginning of the basis period for a year of assessment. 23 rows Tax Relief Year 2018. Here are the income tax rates for non-residents in Malaysia.

The maximum rate was 30 and minimum was 25. Tax Rate Table 2018 Malaysia. Corporate tax rates for companies resident in Malaysia is 24.

Update of PCB calculator for YA2018. What is personal tax rate in Malaysia. Malaysia Non-Residents Income Tax Tables in 2019.

On the First 5000. Check out Complete Info on Tax. Rate TaxRM A.

Employment Insurance Scheme EIS deduction added. Whats people lookup in this blog. In fact there is only one minor change which applies to the medical expenses and examination of the individual spouse or child.

The Resident Tax Relief for Working Expatriates in Malaysia for Year Assessment 2018 is as follows.

2018 2019 Malaysian Tax Booklet

Global Distribution Of Revenue Loss From Tax Avoidance Re Estimation And Country Results Eutax

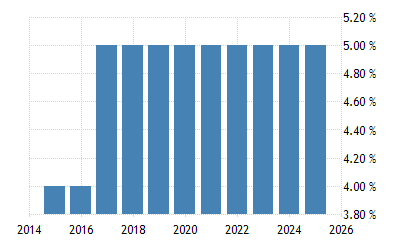

Tonga Sales Tax Rate 2022 Data 2023 Forecast 2014 2021 Historical Chart News

2022 年大马报税需知 纳税人税率 Kadar Cukai 及如何计算税金 Map Screenshot Map Periodic Table

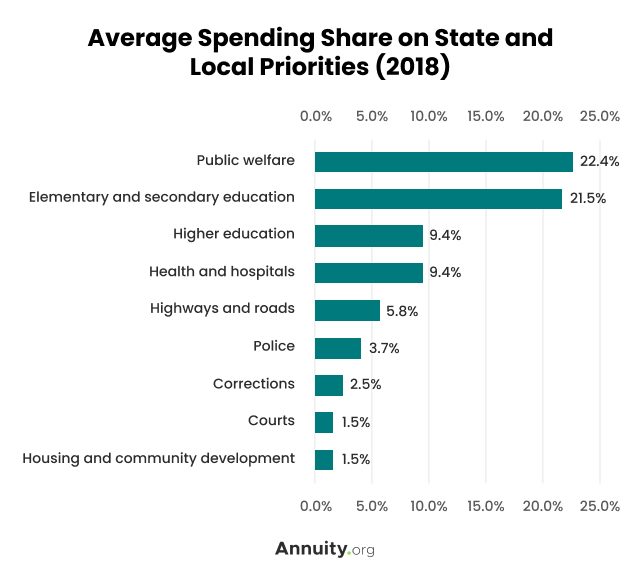

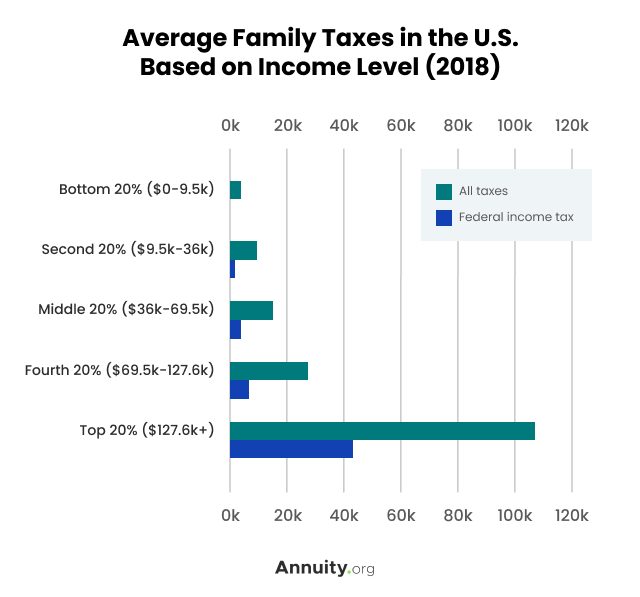

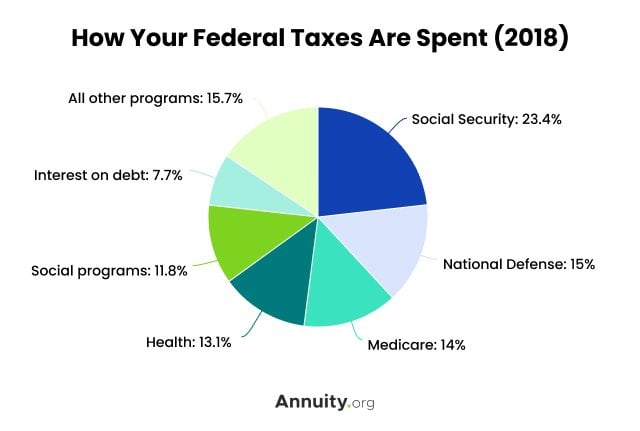

Tax Information What Are Taxes How Are They Used

Eritrea Sales Tax Rate Vat 2022 Data 2023 Forecast 2014 2021 Historical

Israel Corporate Tax Rate 2022 Data 2023 Forecast 2000 2021 Historical Chart

Tax Information What Are Taxes How Are They Used

Corporate Tax Remains A Key Revenue Source Despite Falling Rates Worldwide Oecd

Save Thousands Of Dollars In Taxes With A Student Visa Go Study Australia

Morocco Sales Tax Rate Vat 2022 Data 2023 Forecast 2014 2021 Historical

Poland Personal Income Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical

U S Estate Tax For Canadians Manulife Investment Management

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia